(中文) 2021 年4月24日,南京市律师协会主办的 “涉外培训导师库” 在市律协报告厅举行成立仪式。本所合伙人﹑银行及金融部和诉讼及争议解决部主管徐凯怡律师,获邀加入首批 “涉外律师人才培养导师” 成员之一。

为在南京建立一支通晓国际规则、具有国际视野的涉外法律服务队伍,南京市律协决定成立 “涉外律师人才培养导师团”,以进一步提升南京律师从事涉外法律服务的专业能力。

如阁下想了解更多详情,请联络本所合伙人徐凯怡律师 (heidichui.office@sw-hk.com)。

(中文) 2021 年4月24日,南京市律师协会主办的 “涉外培训导师库” 在市律协报告厅举行成立仪式。本所合伙人﹑银行及金融部和诉讼及争议解决部主管徐凯怡律师,获邀加入首批 “涉外律师人才培养导师” 成员之一。

为在南京建立一支通晓国际规则、具有国际视野的涉外法律服务队伍,南京市律协决定成立 “涉外律师人才培养导师团”,以进一步提升南京律师从事涉外法律服务的专业能力。

如阁下想了解更多详情,请联络本所合伙人徐凯怡律师 (heidichui.office@sw-hk.com)。

(中文) 2021年4月30日, 本所合伙人、 银行与金融部主管徐凯怡律师应华夏银行香港分行 (“华夏”) 邀请担任专业培训讲师﹐为华夏的管理层和员工分享跨境融资业务的法律实务要点。

左起: 本所注册外地律师邓商琳﹑本所合伙人、 银行与金融部主管徐凯怡律师﹑华夏银行 (香港) 副行长林风华女士﹑法律合规部总经理李淇先生和本所公司秘书服务部主管王燕华女士

徐律师在课程上介绍了各项跨境融资业务产品,如内保外贷﹑外保内贷及债券投资等﹐以及不同担保方式或抵押品的法律操作要点。她亦就信贷文件之法律风险和签立文件及注册书须知等热点问题作出了详尽的解说。最后, 徐律师探讨了香港特区政府和香港金管局最新出台的措施和未来计划,包括「债券通」南向交易﹑「绿色及可持续债券市场」和「跨境理财通」等。此次培训全面强化了与会者对跨境融资产品及相关法律实务的理解,并与在场的参会客户在不同领域有更深的交流。

若阁下想了解更多详情,请联络本所合伙人徐凯怡律师 (heidichui.office@sw-hk.com)。

(中文) 一、SPAC在香港的最新动态

SPAC(即Special Purpose Acquisition Company特殊目的收购公司)虽然多年来只盛行于美国资本市场,但经过近几年上市数量及集资金额的爆发性增长后,全球市场都开始更加关注SPAC。截至今年3月31日,仅3个月的时间,美国SPAC上市数量已达298家,募资额约971.26亿美元,上市数量和募资额已经双双超越2020年全年的数字。据报,香港企业家如长和系创办人李嘉诚及新世界发展行政总裁郑志刚等也计划或正在于美国筹组SPAC上市,个别集资额高达4亿美元。

为了提高香港作为国际金融中心的竞争力,香港特区政府已于上月初正式要求港交所及证监会认真研究在香港引入SPAC的上市制度,且有望在年底前在香港落实SPAC上市制度,并在全球的SPAC资本市场中分一杯羹。然而,美国在过去两年爆发性增长后,很多SPAC亦面临未能在限期前完成并购的问题,因此政策制定者也应提防SPAC泡沫爆破的可能性。

同时,虽然不少欧亚国家已容许SPAC上市,单计亚洲区也有南韩及马来西亚,但暂未见如美国般的热潮。香港在这个时期引入SPAC,应参考其他国家在SPAC监管及管治方面的经验,在对投资者的吸引力及保障之间取得好的平衡。

二、SPAC是什么?

SPAC简单来说,是一家上市时只有筹集的资金,只为并购其他公司而成立,没有任何其他业务的「空壳公司」。从投资者的角度来说,则是集上市、并购、私募投资等金融产品特征及目的于一体的金融工具,深受资金充足和客户资源广泛的基金、投行的青睐。

SPAC一般由发起人(如基金管理机构)发起成立,进行首次公开募股(IPO – Initial Public Offering),由券商从机构投资者和散户投资者中筹集资金,经批准后,该只有资金而没有营运业务的公司在证券交易所上市交易。通常,IPO中筹集的现金100%放置在监管帐户中,直到SPAC完成业务合并时才释放。

SPAC的唯一目的就是寻找欲上市的目标企业并洽谈并购,使目标企业获得融资,并代替SPAC成为上市公司,这个过程称为de-SPAC(即「去SPAC化」)。如果SPAC在24个月内未能完成de-SPAC,则该SPAC将面临清盘,并应将其为投资者托管的资金连本带利归还投资者。

在de-SPAC的过程中,SPAC的发起人(Sponsor)会物色合适的目标企业。若双方达成共识,则会签署合作协议并草拟合并文件,交由监管机构审批。获批后,仍须由SPAC的股东在股东大会上投票,通过的话则继续并购的过程。完成合并当天,目标企业既获得资金,又登陆证券交易所成为上市公司。

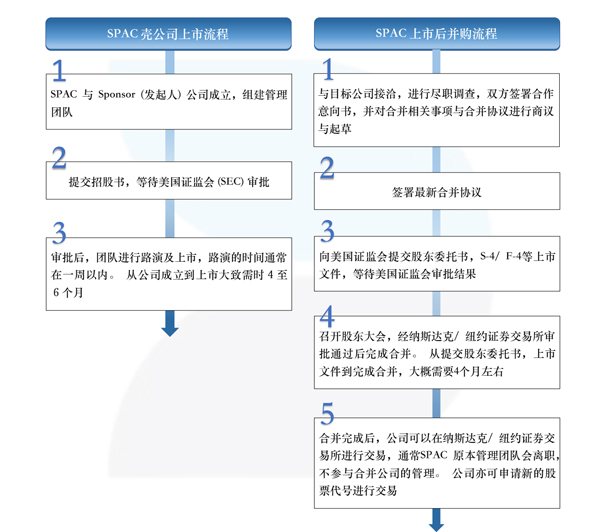

根据美国SPAC的实践,其上市及de-SPAC流程如下图所示。

三、SPAC与传统IPO的区别

与传统IPO不同,SPAC是先有上市公司和资金,再并购合适的公司。对目标公司来说,这就有了可在主板市场上市的确定性,避免了传统IPO申请不获批准,导致上市失败或延迟的风险,同时上市的成本也较低。对投资者来说,若并购对象或未如理想或最终未能成功并购,也有赎回股票的退场机制。

但是SPAC的劣势也不容忽视。首先,SPAC收购目标存在较大不确定性,SPAC的投资者无法得知最终将投资什么公司,亦无任何业绩纪录可作参考,更不保证一定能够完成并购,只能相信发起人团队的眼光及能力。其次。虽然SPAC合并交易需经证监会和交易所审核,但这种审核远不如IPO审核严格,同时也不会充分披露信息。如果SPAC管理团队的尽职调查不到位,可能发生造假上市。由此对于公众投资者而言,SPAC模式仍具有一定投资风险。

四、SPAC的监管重点

1、SPAC是否等同于借壳上市?

SPAC与香港监管机构多年来决心打击的借壳上市(买壳)行为看似相似,两者均是私人企业透过与壳公司进行并购取得上市地位,但两者在过程、披露及投资者保障方面有根本上的分别。

借壳上市(又称反收购Reverse Takeover)一般发生在一家规模较小或业务无以为继的上市公司,与一家规模相对较大的私人企业之间,名义上是上市公司收购私人企业以扩展业务,实质为把私人业务及资产上市,又能规避新上市规定的一种方法。壳公司的价值曾经达到数亿港元,导致不少人巧立名目造壳以图利。但这种手法一般枉顾其他投资者的利益,擅自改变上市公司的业务及处置资产,也大大损害市场的诚信、稳健及质素,影响投资者的信心,因此成为港交所的重点打击对象。

为针对并遏止借壳上市的做法,港交所在2019年修订《上市规则》第14章及刊发三封指引信等,以对市场上的借壳上市行为作出定义及纳入规管,赋予港交所较大空间去行使停牌及除牌等监管权力,提高借壳上市的门槛至类似IPO的披露要求,并限制控制权转手后的资产处置等。在现行的监管制度下,在香港借壳上市变得相当困难。

SPAC的分别在于其「成立壳公司」以「并购私人企业」的目的是透明公开的,无论是壳公司的成立、集资、并购私人公司的变相上市都是由发起人主导,并在监管机构的监视下按游戏规则进行,而过程中股东有权离场及对并购进行表决。在这个开诚布公的前题下,就没有了过往借壳上市会影响市场运作,造成虚假市场的弊病。

2、如何确保SPAC的发起人尽其职责?

一般来说,在设立SPAC时,SPAC的发起人可获得创始人股份,约占SPAC总股本的20%,这是其承担在合并交易完成之前,SPAC的设立和维护费用(约500万美元)的对价。除此之外,发起人不能从SPAC集资资金中提取薪酬或收取任何管理费。发起人的股份通常在SPAC合并完成后的一年内禁售。另外,若SPAC在限期内未能成功de-SPAC,其20%股份并不会获退还,因其对价(即设立和维护费用)已对外支付。

在这样的前提下,发起人有很大的诱因去完成de-SPAC,防止其努力付诸流水;同时,发起人也要小心挑选并购的业务,并努力运用发起人的影响力使之成功,才能确保其股份能转化为有价值的投资。在此之上,发起人(包括SPAC的董事会成员和管理层)与被并购对象的董事高管不可以有任何关系或拥有任何利益。

相对而言,传统IPO的保荐人为受证监会监管的机构,为了本身的业务理应尽其保荐人责任,有更大的诱因确保整个IPO过程都合规合法。但由于其报酬并不受上市公司的股价表现影响,所以即使对过往业绩做过充份的调查,但对业务日后的成功与否,则未必是其首要任务。

为加强SPAC发起人努力的诱因及防止发起人匆忙进行de-SPAC,监管机构可以考虑加入发起人出资的要求,以及延长禁售期。同时,若要加强对发起人的监管,也可以考虑在de-SPAC的中介团队中加入类似传统IPO保荐人的持牌人角色,去确保de-SPAC团队工作的合规性及提高对证监会的问责性。

3、关于被并购对象的资料,披露是否充份?

通常在SPAC与并购对象签署合并意向书后,会花大约三至五个月完成被并购方的审计、重组(如需要)、法律尽调、投资银行进行的价格评估,并由律师起草合并文件。在一般SPAC的并购过程中,对目标公司的监管及审查不及传统IPO,中介进行的调查也相对有限。

尽职调查的意义在于减低目标公司在重要事项上欺瞒投资者及监管机构的风险。发起人无论在管理或投资方面有多少经验及知名度,都不能取代实质、到位的尽调工作。

然而,若按《上市规则》第14章有关反收购的门槛去处理,要求de-SPAC达到IPO的标准,则令SPAC失去其让私人企业快速上市的优势。香港的监管机构在制定相关尽调要求时,适宜在中间着墨,在保留市场竞争力之余,提升对投资者的保障。

4、退场机制是否能保障投资者?

美国在经历SPAC的热潮后,有很多SPAC正面对在限期内找不到收购对象的问题。即使给予发起人充足的诱因,也不能解决市场上有可能出现的SPAC资金供过于求的情况。因此,能保障投资者(包括退出的投资者,以及留下的投资者)的退场机制至为重要。

一般SPAC的退场机制有两种。首先,如果SPAC未能在成立后的二十四个月内完成合并交易,则监管账户中的募集资金(包括发起人的出资和投资者的出资)将全额原路退回。其次,在SPAC完成de-SPAC之前,投资者可以于任何时候要求SPAC回购股份,取回自己的投资。这对于投资者可能不满意发起人或并购对象时,可以终止对项目的投资。

唯投资者的中途退场,意味着SPAC用于并购的资金减少,影响并购最后的成功与否。要保障留下来的投资者,可以考虑限制退场的时间在SPAC提出并购目标前,以及在股东投票后(只限投反对票的投资者),以免并购过程因投资者时机不当的退场而失败。

五、总结

正如前文所述,香港正在积极考虑引入SPAC制度。作为较迟加入SPAC市场的一方,香港有着前车可鉴的优势,同时也面对新加坡同一时期加入SPAC的竞争。若特区政府希望SPAC在香港能够取得成功,必须从香港的实际情况出发,在提升香港作为SPAC上市平台的吸引力的同时,加强对投资者,尤其是散户投资者的保障。

本文由本所曾浩贤高级律师、陈正斌律师,及中国执业律师沈佳颖共同合著。如有任何疑问或需要进一步的信息,请联系本所曾浩贤高级律师。

本新闻简讯仅供参考之用。其内容不构成亦不应被视为法律意见。史蒂文生黄律师事务所对于任何因根据或倚赖本文件所载资料所作决定,行动或不行动而引致的损失或损害,史蒂文生黄律师事务所概不负责。

On 31 March 2021, The Stock Exchange of Hong Kong Limited (the “Exchange”) published a consultation paper (the “Consultation Paper”) on a proposed streamlined listing regime for overseas issuers. According to the Exchange, this is contextual to its Strategic Plan 2019-2021 announced in February 2019, which contained an initiative to continue to develop Hong Kong as a listing and capital raising hub for major global and regional companies on either a primary or secondary basis, thereby attracting global investments seeking exposure to Asia Pacific companies and Mainland investors seeking international exposure.

The Exchange considered the current regime is affected by issues such as complexity of requirements for overseas issuers, inconsistent shareholder protection standards for recognised jurisdictions and acceptable jurisdictions, co-existence of two secondary listing regimes and more restrictive secondary listing requirements for issuers with a centre of gravity in Greater China. In view of these and other issues set out in the Consultation paper, the Exchange set out its proposals, for comment, on amendments to the Listing Rules to streamline the existing regime for overseas issuers (including those with a centre of gravity in Greater China), and also make consequential amendments to the requirements for all issuers (including Hong Kong issuers and PRC issuers).

Summary of proposals

The proposals of the Exchange are at the following dimensions. Comparison is made with the existing regime for illustrative purpose. Capitalised terms shall have the same meaning as defined in the Consultation Paper.

|

Existing Regime |

Proposed Regime |

| 1. Recognised Jurisdictions and Acceptable Jurisdictions | |

|

a. Three “Recognised Jurisdictions” – Bermuda, the Cayman Islands and the PRC b. 28 “Acceptable Jurisdictions”, i.e. jurisdictions (other than Hong Kong, the Cayman Islands, Bermuda and the PRC) that the Exchange has accepted as an issuer’s place of incorporation eligible for listing in Hong Kong |

a. No more distinction between Recognised Jurisdictions and Acceptable Jurisdictions |

| 2. Shareholder protection standards | |

|

a. All issuers must comply with Appendix 3 to the Listing Rules b. Overseas Issuers incorporated in Recognised Jurisdictions must comply with the applicable part of Appendix 13 to the Listing Rules c. Overseas Issuers incorporated in Acceptable Jurisdictions must demonstrate they can comply with the Equivalence Requirement (i.e. the Listing Rules requirement that an Overseas Issuer must be incorporated or otherwise established in a jurisdiction where the standards of shareholder protection are at least equivalent to those provided in Hong Kong) by meeting the JPS Key Shareholder Protection Standards set out in the Country Guides d. However, “Grandfathered Greater China Issuers” (i.e. Greater China issuers primary listed on a Qualifying Exchange, namely, the New York Stock Exchange LLC, NASDAQ Stock Market or the Main Market of the London Stock Exchange plc (and belonging to the UK Financial Conduct Authority’s “Premium Listing” segment) on or before 15 December 2017) and Non-Greater China Issuers (i.e. issuers primary listed on a Qualifying Exchange, which are not issuers with centre of gravity in Greater China) are subject to another set of requirements in Chapter 19C |

a. The shareholder protection standards in Chapter 19C of and Appendices 3 and 13 to the Listing Rules and the JPS will be replaced by one common set of Core Standards applicable to all issuers to establish a baseline level of investor protection for all issuers regardless of their places of incorporation b.The Core Standards cover the most fundamental shareholders’ rights relating to the notice and conduct of shareholders’ meetings, approval of important matters, members’ right to requisition a meeting, remove directors, vote, speak and appoint proxies/corporate representatives, auditors, appointment of directors to fill casual vacancies and inspection of shareholders’ register, etc. which are based on standards set out in the HKCO or already required under the Listing Rules. c.The Equivalence Requirement will be repealed as a result |

| 3. Dual primary listings | |

|

a. Grandfathered Greater China Issuers with Non-compliant WVR and/ or VIE Structures cannot retain such structures while applying for dual primary listing directly, but may become dual primary listed on the Exchange with such structures if they secondary list in Hong Kong first, and subsequently there is significant demand for their shares such that the Trading Migration Requirement (i.e. the requirement under Listing Rule 19C.13 that if the majority of trading in Greater China Issuer’s listed shares migrates to the Exchange’s markets on a permanent basis, the Exchange will regard the issuer as having a dual primary listing and consequently the Automatic Waivers will no longer apply to such issuer) is triggered b. Common Waivers available to primary and dual-primary listed Overseas Issuers are set out in the JPS |

a. Grandfathered Greater China Issuers and Non-Greater China Issuers with non-compliant WVR and/ or VIE Structures may apply directly for a dual primary listing and retain the non-compliant structures, as long as they meet the eligibility and suitability requirements of Chapter 19C for Qualifying Issuers with a WVR structure b. Codification of some conditional Common Waivers for dual-primary listed issuers and the principles for granting Common Waivers |

| 4. Secondary listings | |

|

a. Two routes: the JPS (only available to Overseas Issuers that do not have a centre of gravity in Greater China) and Chapter 19C of the Listing Rules b. Common Waivers available to secondary listed Overseas Issuers are only set out in the JPS c. Automatic Waivers are (a) set out in the JPS for JPS Secondary Issuers; and (b) codified in Chapter 19C of the Listing Rules for issuers with, or seeking, a secondary listing under that chapter d. Greater China Issuers with or without a WVR structure must (i) demonstrate that they are “Innovative Companies”; and (ii) have a minimum market capitalisation at listing of HK$40 billion (or HK$10 billion with revenue of HK$1 billion in the most recent audited financial year) e. Only Greater China Issuers are subject to the Trading Migration Requirement f. JPS Automatic Waivers eligibility requirements: (i) Listing on a Recognised Stock Exchange (as set out in JPS); (ii) Five years’ good compliance record; (iii) Market capitalisation of US$400 million (approximately HK$3.1 billion) or more g. Listing Rules are silent on the application of Automatic Waivers for a secondary listed issuer that de-lists from the stock exchange on which it is primary listed h. Listing Rules are silent on whether a Grandfathered Greater China Issuer or a Non-Greater China Issuer can retain its Non-compliant WVR and/ or VIE Structures if it delists from the overseas exchange on which it was primary listed |

a. Codification and consolidation of requirements of the two routes to secondary listing b. Codification of all secondary listing related JPS provisions (including Common Waivers and Automatic Waivers for JPS Secondary Issuers) into Chapter 19C of the Listing Rules c. Non-WVR Greater China Issuers seeking a secondary listing (i) are no longer required to demonstrate that they are “Innovative Companies”; and (ii) have the option of meeting a minimum market capitalisation at listing of either HK$3 billion (with a track record of good regulatory compliance of at least five full financial years on a Qualifying Exchange or on any Recognised Stock Exchange, as the case may be) or HK$10 billion (with a track record of good regulatory compliance of at least two full financial years on a Qualifying Exchange) d. All secondary listed issuers are subject to the Trading Migration Requirement e. Codification of JPS Automatic Waiver eligibility requirements with minor modifications: (a) the compliance record requirement changed from “five years” to “five full financial years”; and (b) the minimum expected market capitalisation requirement changed from US$400 million to HK$3 billion f. An issuer will be regarded as having a primary listing on the Exchange upon its de-listing from the stock exchange on which it is primary listed. The issuer shall notify the Exchange in advance of any anticipated de-listing (voluntary or involuntary) from the stock exchange on which it is primary listed and, among other things, details of any proposed waivers or continued relief/ grace period for full compliance with any Listing Rules requirements (including the bases for requesting such waivers/ relief/ grace period) g. The Exchange may, on a case-by-case basis, exercise its discretion to grant a time-relief waiver, suspend trading of the issuer’s shares or impose other measures as it considers necessary for the protection of investors and the maintenance of an orderly market. The Exchange will issue relevant guidance. h. A Grandfathered Greater China Issuer or a Non-Greater China Issuer is allowed to retain its Non-compliant WVR and/ or VIE Structures (subsisting at the time of its secondary listing in Hong Kong) if it de-lists from the Qualifying Exchange on which it is primary listed |

Analysis and Takeaways

The Consultation Paper represents an attempt of the Exchange to unify the existing regimes relating to the application for dual primary and secondary listings of overseas issuers. As the Exchange observed, the market feedback was that the rules are “fragmented, complex and difficult to navigate”, and as a result, the complexity of these requirements may not be conducive to compliance.

The proposed changes are expected to enhance comprehensibility of the rules and the regulatory regime as a whole, resulting in higher regulatory certainty. It is expected that this may create incentives for overseas issuers which are already primary listed in other exchanges, to explore possibilities of applying for dual primary listing or secondary listing on the Exchange.

It should also be noted that the proposed changes have removed certain more restrictive requirements for issuers with a centre of gravity in Greater China. This may well encourage and facilitate further “homecoming” secondary listing attempts of these issuers.

Please contact our Partner Mr. Rodney Teoh for any enquiries or further information.

This newsletter is for information purposes only. Its content does not constitute legal advice and should not be treated as such. Stevenson, Wong & Co. will not be liable to you in respect of any special, indirect or consequential loss or damage arising from or in connection with any decision made, action or inaction taken in reliance on the information set out herein.

(中文) 《修订条例》将于下月全面生效

香港《2021年仲裁 (修订) 条例》(下称「《修订条例》」) 将于下月,即2021年5月19日,全面生效。《修订条例》旨在实施由最高人民法院与香港特区政府订立的《关于内地与香港特别行政区相互执行仲裁裁决的补充安排》(下称「《补充安排》」),以及作出轻微文本修订,并更新《仲裁 ( 纽约公约缔约方 ) 令》(第609章,附属法例A)。《修订条例》共有3个部分,其中包括:

(1) 第1部的导言,规定了该条例的简称及生效日期;

(2) 第2部的修订《仲裁条例》,包括根据补充安排的修订内容,取消对于认可内地仲裁当局的「名单制」以及允许当事方同时向内地和香港特区的法院申请执行仲裁裁决;及

(3) 第3部的修订《仲裁 (纽约公约缔约方) 令》,在附表加入帕劳、埃塞俄比亚、汤加和塞拉利昂四个缔约方。

回顾《补充安排》的签署

2020年11月27日,香港特区政府与最高人民法院签署《补充安排》,对两地于1999年6月21日签订的《关于内地与香港特别行政区相互执行仲裁裁决的安排》(下称「《安排》」) 进行修订,在以下几个方面对《安排》的内容进行进一步的完善:

(a) 更明确地订明在《安排》有关执行仲裁裁决方面涵盖「认可」一词;

(b) 更明确地以明文厘清当事方可以在法院接受执行仲裁裁决的申请之前或之后申请保全措施;

(c) 取消对于认可内地仲裁当局的「名单制」,使仲裁裁决范围的定义与国际上普遍采用的《纽约公约》的「仲裁地」定义方式保持一致;及

(d) 免除目前在《安排》下的限制,允许当事方同时向内地和香港特区的法院申请执行仲裁裁决。

上述第 (a) 及 (b) 项的修订已经于《补充安排》签订的同日生效,即2020年11月27日。而第 (c) 及 (d) 项的修订将通过《修订条例》于2021年5月19日起正式生效。

《修订条例》及《补充安排》对两地仲裁的影响

《修订条例》对《补充安排》的修订内容进行了更加全面及贯彻的实施,无疑为两地仲裁裁决的相互执行提供了助力及便利。

由于《修订条例》取消了对于认可内地仲裁机构的限制,更多内地仲裁机构以及在内地的域外仲裁机构作出的仲裁裁决会在香港得到认可和执行,这样一来,当事方在内地进行仲裁亦会有更广泛的仲裁机构选择。

另外,长久以来内地与香港存在不能同时在两地申请执行仲裁裁决的限制,因此经常会出现由于内地或者香港执行程序耗时较长,胜诉当事方在申请第二次执行程序时可能已经超出诉讼时效,或者被执行人已经进行了资产转移。《修订条例》生效后,这一环节将得到完善。允许胜诉当事方同时向内地和香港法院申请执行仲裁裁决,对胜诉当事方的利益提供了保障,亦在一定程度上对被执行人转移资产的恶意行为作出了限制,加强了两地仲裁裁决的执行效率和执行力度。

从长远的角度而言,《补充安排》在促进涉及内地与香港的国际贸易方面具有特殊地位,为从事国际商业贸易的公司和个人在解决争议的方面提供了极大的便利和更多的选择。相信《修订条例》及《补充安排》的全面实施,会进一步促进香港法律及争议解决服务的发展,并且提升香港作为法律、促成交易及争议解决服务的国际法律枢纽的地位。

本文由本所合伙人,诉讼及争议解决部主管徐凯怡律师和黄晊晄律师撰写。若阁下想了解更多详情,请联络本所徐凯怡律师 (heidichui.office@sw-hk.com)。

于本文中提供的一切资料仅供参考,不构成任何法律意见,资料亦受制于适用规定及法例不时的更新与修改。若需取得相关法律意见,须咨询法律顾问。

Fraudulent Website Alert

It has come to our attention that fraudulent Facebook pages promoting as a law firm or organisation under the name of (1) “邦得国际律师事务所-李律师”/“邦得国际律师事务所-林律师”, (2) “源凯国际律师事务所咨询处”, and (3) “香港維權中心”, all use a stolen photograph of our partner, Ms. Heidi Chui, as part of their Facebook profile photographs. Ms. Heidi Chui has confirmed that her photograph was used without her knowledge and authority. The matters have been reported to regulators and authorities for further action.

Please be informed that our firm and Ms. Heidi Chui are not in any way whatsoever affiliated with “邦得国际律师事务所-李律师”/“邦得国际律师事务所-林律师”, or “源凯国际律师事务所咨询处” or “香港維權中心” or those Facebook pages.

Please also refer to the Scam Alert page on the website of the Law Society of Hong Kong for more details (https://www.hklawsoc.org.hk/en/Serve-the-Public/Scam-Alert).

Please take caution and do not click on any suspicious links or provide any personal information on any suspicious websites, emails or messages.

All rights of our firm and Ms. Heidi Chui are hereby expressly reserved.

Should you have any question, please contact us at info@sw-hk.com.

Thank you for your attention.

Stevenson, Wong & Co.

23 November 2023