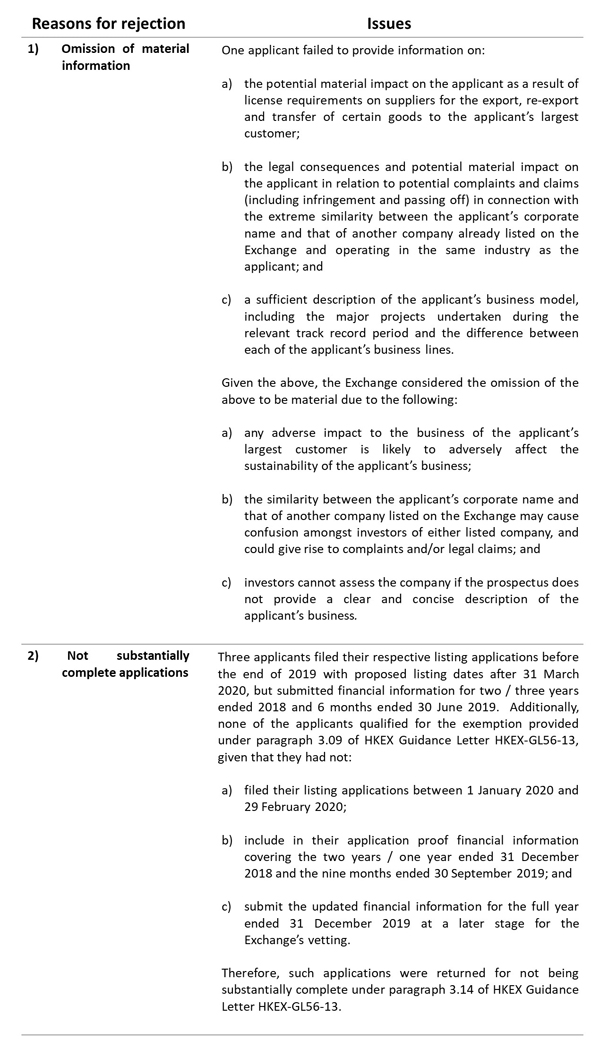

Background

On 5 June 2020, The Stock Exchange of Hong Kong Limited (the “Exchange”) published two listing decisions1 (collectively, the “Listing Decisions”) to provide guidance on the reasons that the Exchange rejected certain listing applications. In 2019, the Exchange rejected 18 listing applications (comprising 6% of the total listing applications in 2019) and returned 4 listing applications (as compared to nil for 2018). It was acknowledged that the percentage of listing applications rejected remains stable.

In this newsletter, we will provide (1) a summary on the reasons for rejection and return of listing applications; and (2) an outline of certain requirements on financial information to be submitted together with the listing application so as to constitute a substantially complete listing application.

Rejected Listing Applications

Rejected listing applicants failed to meet the requirements of the Exchange in the vetting process in terms of suitability and eligibility. In particular, a higher level of scrutiny is placed on the applicant’s commercial rationale in order to evaluate whether the applicant has a genuine need for funding. Where the Exchange has reason to believe that the applicant is listing for a purpose other than the development of its underlying business or assets, or that the company’s scale no longer justifies the costs or purposes associated with a public listing, it may lead to rejection of its listing application.

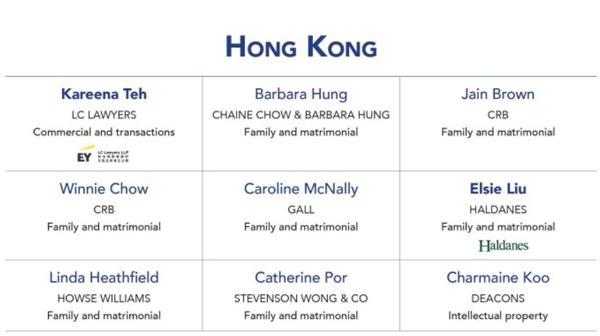

Please refer to the table below for a summary of the Exchange’s reasons of rejection of listing applications:

Returned Listing Applications

Furthermore, in the event where a listing applicant submits a listing application which the Exchange decides is not substantially complete, the Exchange will suspend the vetting process and return all submitted documents to the sponsor. Insufficient financial information included in accountants’ reports and/or profit forecast memorandum submitted for a listing application would likely lead to the return of the listing application.

Applicable Rules and Guidance

An applicant is required to submit a listing application form, an application proof and all other relevant documents, and the information therein must be substantially complete, except in relation to information that by its nature can only be finalised and incorporated at a later date2. Additionally, the accountants’ report submitted together with the listing application must include consolidated results for each of the three financial years (two financial years for GEM applicants) immediately preceding the issue of the listing document3, and such latest financial period reported on by the reporting accountants must not have ended more than six months before the date of issue of the listing document4.

HKEX Guidance Letter HKEX-GL25-11 provides that the Exchange may grant waivers from strict compliance with the aforementioned rules provided that the applicant will list on the Main Board within three months (or will list on GEM within two months) after the latest financial year end. HKEX Guidance Letter HKEX-GL56-13 provides the conditions and examples of when the Exchange will accept an application proof with an accountants’ report covering a period shorter than as required under the Main Board Listing Rules or GEM Listing Rules.

In determining whether the financial information included in an application proof is substantially complete, the Exchange would take into account the applicant’s proposed listing date to determine the relevant track record period (“TRP”) for which the accountants’ report should be included in the application proof of the prospectus.

Financial Information Requirements

The Exchange highlighted the following examples:

(1) if a Main Board applicant’s most recent financial year ends on 31 December 2019 and its proposed listing date is on or after 1 April 2020, the accountants’ report to be included in the final prospectus should at least cover the three financial years ended 31 December 20195.

For the purposes of the application proof, under HKEX Guidance Letter HKEX-GL56-13:

(a) if the applicant files its application before the most recent financial year end (i.e. end of December 2019), the application will be returned for not being substantially complete as the Exchange has insufficient basis / information to assess the listing application as the applicant had yet to have completed the last full financial year of its TRP (i.e. the year ended 31 December 2019); but

(b) if the applicant files its application between 1 January 2020 and 29 February 2020, the applicant can include an accountants’ report with a shorter period (i.e. the two financial years ended 31 December 2018 and nine months ended 30 September 2019) in the application proof. However, the applicant must submit a complete accountants’ report for the three financial years ended 31 December 2019 at a later stage for the Exchange’s vetting.

(2) if a Main Board applicant in the above example (i.e. with its most recent financial year which ends on 31 December 2019) intends to list on or before 31 March 2020 instead and the applicant is eligible to apply for a waiver from Rule 4.04(1) of the Main Board Listing Rules, the accountant’s report to be included in the application proof should at least cover the three financial years ended 31 December 2018 and six months ended 30 June 2019.

Profit Forecast Memorandum

Pursuant to Rule 9.11(10)(b) of the Main Board Listing Rules (or Rule 12.22(14b) of the GEM Listing Rules), where the application proof does not contain a profit forecast, a final or advanced draft of the profit forecast memorandum covering the period up to the forthcoming financial year end date after the date of listing (taking the proposed date of listing as indicated by the applicant) must be submitted together with the listing application.

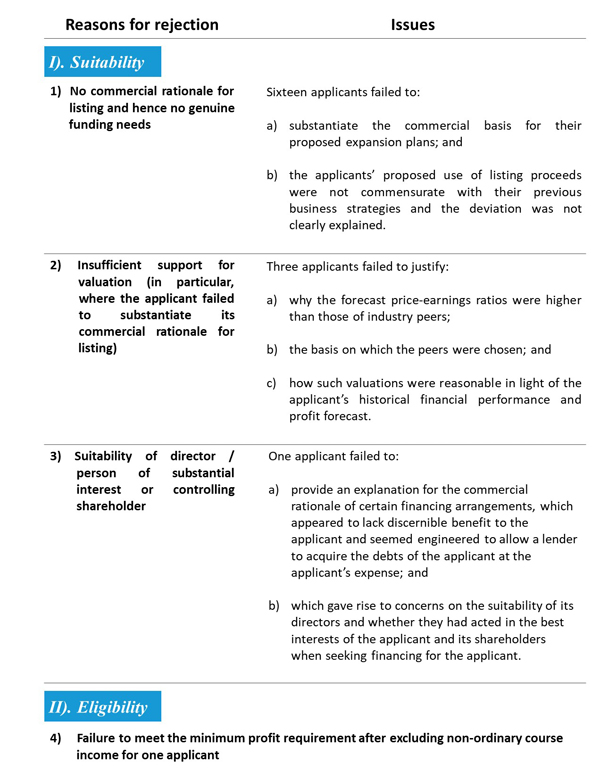

Examples of Listing Applications Returned by The Exchange

Conclusion

The Exchange will reject listing applications on the basis of suitability and eligibility. Where the applicant could not demonstrate sufficient commercial rationale for listing and failed to justify genuine funding needs, or show sufficient support for valuation, or its director(s), substantial shareholder(s) or controlling shareholder(s) appeared to be unsuitable, it may lead to the Exchange rejecting its listing application on grounds of suitability. On the other hand, if the applicant failed to meet the minimum profit requirement (after excluding non-ordinary course income), it may lead to the Exchange rejecting its listing application on grounds of eligibility.

The Exchange will return cases that are not substantially complete. Applications that were submitted with (1) material information omitted in the application proof; or (2) contained insufficient financial information for the respective track record period required under the relevant Listing Rules will be returned.

Please contact our Hank Lo or Rodney Teoh for any further enquiries or information.

This newsletter is for information purposes only. Its content does not constitute legal advice and should not be treated as such. Stevenson, Wong & Co. will not be liable to you in respect of any special, indirect or consequential loss or damage.

1 HKEX-LD126-2020 and HKEX-LD127-2020

2 Rule 9.03(3) of the Main Board Listing Rules (or Rule 12.09(1) of the GEM Listing Rules) and Rule 9.10A(1) of the Main Board Listing Rules (or Rule 12.22 and 12.23 of the GEM Listing Rules)

3 Rule 4.04(1) of the Main Board Listing Rules (or Rule 7.03(1) and 11.10 of the GEM Listing Rules), Paragraph 27 of Part I and Paragraph 31 of Part II of the Third Schedule to the Companies (Winding Up and Miscellaneous Provisions) Ordinance

4 Rule 8.06 of the Main Board Listing Rules (or Rule 11.11 of the GEM Listing Rules)

5 Rule 4.04(1) of the Main Board Listing Rules (or Rule 7.03(1) and 11.10 of the GEM Listing Rules)