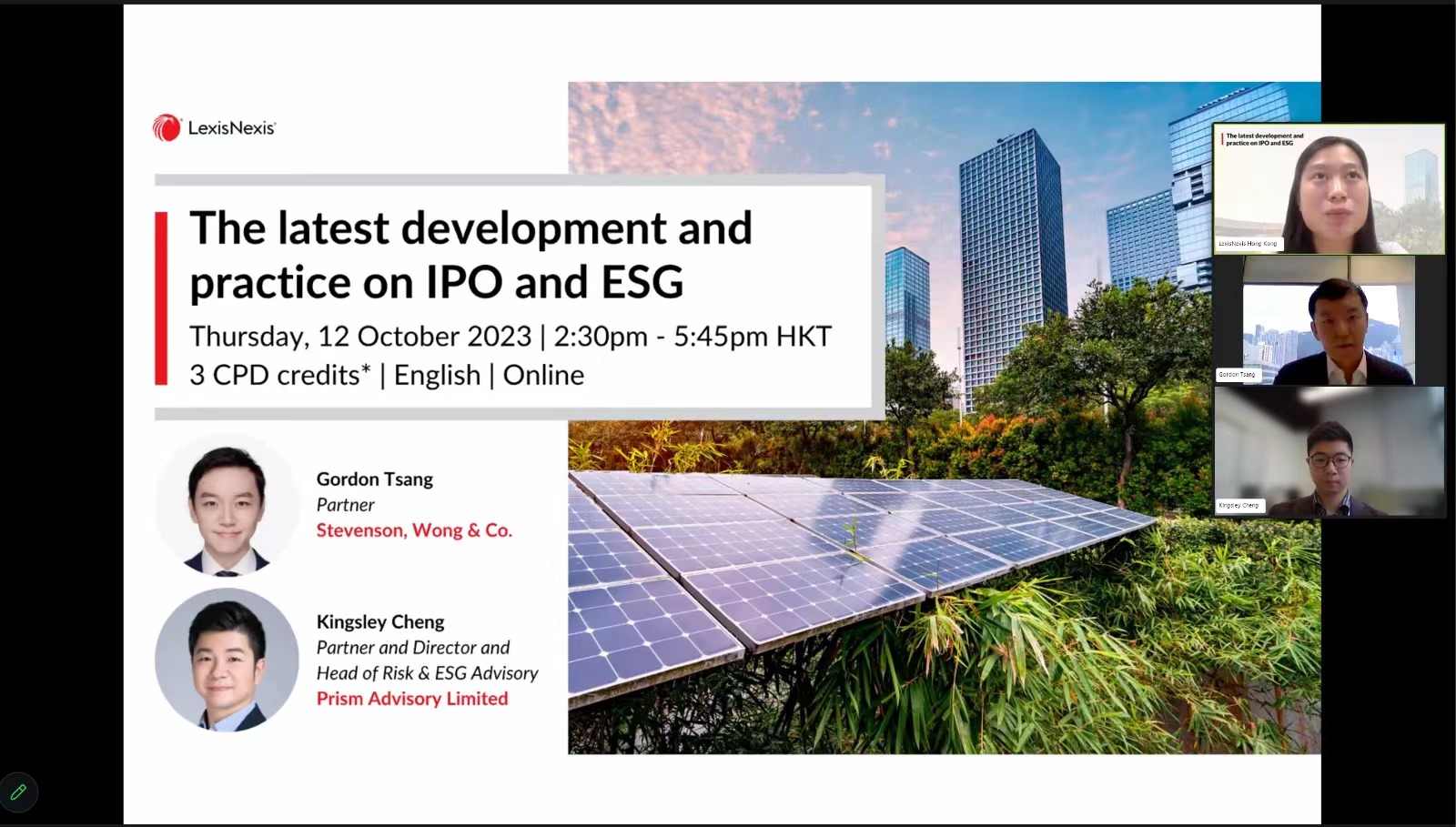

On 12 October 2023, our Partner Gordon Tsang was invited by LexisNexis to give a Continuing Professional Development (CPD) course on “The latest development and practice on IPO and ESG”.

During the 3-hour webinar, Mr Tsang, along with Kinglsey Cheng, Partner and Director and Head of Risk & ESG Advisory of Prism Advisory Limited, provided a comprehensive overview of Hong Kong’s IPO market by sharing their insights into the latest updates on listing requirements, relevant listing decisions, and new regimes. In the second part of the webinar, they focused on the crucial aspect of ESG considerations in the IPO process and outlined the corresponding listing requirements.

Please contact Mr. Gordon Tsang for any enquiries or further information.