(中文) 自最早发行至今,非同质化代币 (Non-Fungible Tokens)(下称「NFT(s)」) 现在已成为众所周知的「有价值的商品」。然而,由于存在的历史相对较短,大多数国家和司法管辖区尚未充分认可NFTs或加密货币资产 (crypto assets) 的法律地位,也未能提供全面的监管框架。

2021年11月1日,在一款名为「鱿鱼币 (SQUID Tokens)」的开发商携款潜逃后,该代币的投资者遭受了巨额损失,共计250万美元。这一骗案为投资与公众者提供了及时的警告,提醒投资者与公众不可忽视与NFTs相关的风险。鉴于投资者与公众对NFT市场的兴趣日益增加,本文旨在简要介绍全球主要市场NFTs的近期发展概况,包括对于NFTs法律地位的司法认可,以及NFTs在娱乐行业的最新应用。

首先,有必要指出的是,一些国家在一定程度上禁止NFTs或与NFTs相关的交易。例如,中国人民银行于2021年9月24日完全禁止加密货币交易,而印度的立法者正在考虑将持有、发行、采矿、交易和转移加密货币资产的行为定为犯罪行为。

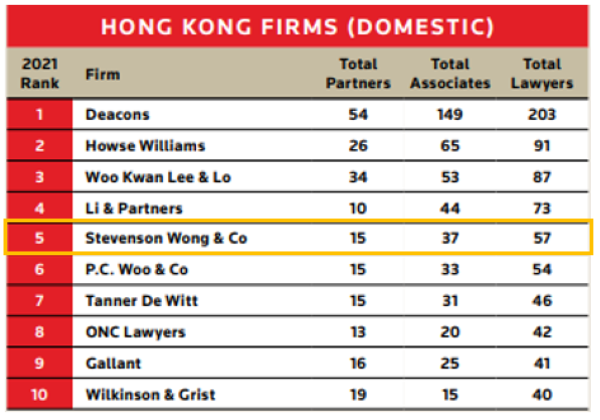

香港

在香港,一般的规管情况是若NFTs被视作符合《证券及期货条例》(第517章)(下称「香港证券条例」) 附表1所列的「证券 (securities) 」的定义,则该等NFTs便会受到香港证券及期货事务监察委员会 (下称「香港证监会」) 的规管。然而,如果此类代币不属于香港证券条例「证券」的定义,则它们将不受香港证券条例的监管管辖。

同时,在民事救济方面,香港高等法院在Nico Constantijin Antonius Samara v Stive Jean Paul Dan [2019] HKCFI 2718一案中已经确认了加密代币的「数字资产 (digital assets)」的地位,并批准了冻结该案被告的资产玛瑞瓦禁令 (Mareva Injunction),其中包括被告持有的比特币 (Bitcoin)。然而,香港法律对于NFTs是否被认定为「普通个人财产」 未有清晰定义。

在2021年8月中旬,一家位于瑞士的第三方资助者(third-party funder)资助了超过700名申请人在香港国际仲裁中心对币安(Binance)(加密货币的主要交易所和交易平台) 开展仲裁程序。该仲裁程序是关于币安今年5月网上交易平台崩盘而引发的争议。该仲裁案件将会为香港法律界及仲裁界带来许多独特的挑战,包括 (除其他外) 将香港单一标准 (香港法作为管辖法律) 适用于解决多个国家和司法管辖区关于有争议的或至少是尚未确定的NFTs交换和交易领域服务的争议。

英国

与香港不同,英国高等法院在AA v Persons Unknown [2019] EWHC 3556 (Comm)一案中已经确认加密资产被视为「财产」并批准了有关原告作为赎金的比特币的所有权强制令 (proprietary injunction)。此后,英国法院一般都愿意向NFT相关的骗案受害者提供标准民事救济,以帮助识别欺诈者和确定相关资金的去向。

除了在法庭上有关NFT的讨论之外,英国Stephenson Law律师事务所更是于2021年10月25日推出了一组三种不同的代币 (其中一种代币将使买家有权与律所创始人进行一对一的会面),成为首家推出NFT的律师事务所。

美国

在美国,NFTs越来越多地被应用于娱乐行业。自从数字艺术家迈克温克尔曼 (又名Beeple) 以6,900万美元的价格成功出售其创作的NFT后,美国娱乐行业对将影视作品的视听片段甚至手写剧本转换为NFT的兴趣日益增加。2021年11月初,昆汀塔伦蒂诺 (Quentin Tarantino) 宣布计划出售电影 《低俗小说》(Pulp Fiction)的原版手写剧本。然而,就在几天之内,这部电影的制片人米拉麦克斯影业 (Miramax) 就以违反合同、侵犯版权和商标为由提起了诉讼。尽管有关艺术品模糊的所有权以及相关知识产权的问题可能已经威胁到了其他一些NFTs的发行,但该等纠纷对于行业与NFTs的进一步联动发展而言可谓恰逢其时。

与此同时,NFTs的交易也面临着挑战。2021年5月12日,一名原告起诉了Dapper Labs, Inc. (下称「Dapper」) 及其首席执行官,指称Dapper因在其交易平台NBA Top Shot出售NFTs而违反证券法。原告认为,由于NFTs是「从一个特定的项目、发起人或初创企业的成功或失败中获得其价值 (derive their value from the success or failure of a given project, promoter, or start-up)」的数字资产,NFTs应当在美国证券交易委员会进行登记。目前法院尚未对Dapper一案作出判决,但这一具有里程碑意义的案件预计将为NFT交易的当事人提供有用的指引,甚至为香港证券条例的监管范围提供参考。

结论

在过去一年,NFTs在全球范围内受到了前所未有的欢迎和关注。相信在不久的将来,NFTs与合同和知识产权法之间的相互作用会继续增多,NFTs在各行业的应用会继续扩大,而对NFTs市场的投资也会继续增加。

在这个关键时刻,各个司法管辖区的监管机构有可能会对加密货币资产提供进一步的监管,并就加密货币的法律地位提供指引。同时,投资者和公众在评估和投资NFTs时应更加谨慎并做好尽职调查。

本文由本所合伙人,诉讼及争议解决部主管徐凯怡律师和黄晊晄律师撰写。若阁下想了解更多详情,请联络本所徐凯怡律师 (heidi.chui@sw-hk.com)。

于本文中提供的一切资料仅供参考,不构成任何法律意见,资料亦受制于适用规定及法例不时的更新与修改。若需取得相关法律意见,须咨询法律顾问。