Fraudulent Website Alert

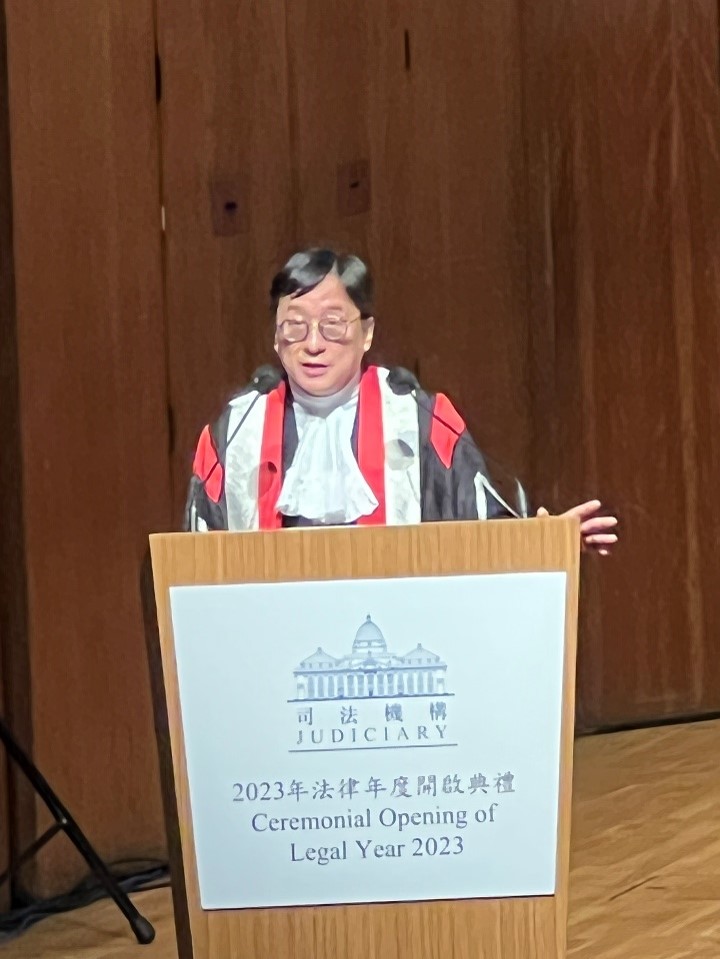

It has come to our attention that fraudulent Facebook pages promoting as a law firm or organisation under the name of (1) “邦得国际律师事务所-李律师”/“邦得国际律师事务所-林律师”, (2) “源凯国际律师事务所咨询处”, and (3) “香港維權中心”, all use a stolen photograph of our partner, Ms. Heidi Chui, as part of their Facebook profile photographs. Ms. Heidi Chui has confirmed that her photograph was used without her knowledge and authority. The matters have been reported to regulators and authorities for further action.

Please be informed that our firm and Ms. Heidi Chui are not in any way whatsoever affiliated with “邦得国际律师事务所-李律师”/“邦得国际律师事务所-林律师”, or “源凯国际律师事务所咨询处” or “香港維權中心” or those Facebook pages.

Please also refer to the Scam Alert page on the website of the Law Society of Hong Kong for more details (https://www.hklawsoc.org.hk/en/Serve-the-Public/Scam-Alert).

Please take caution and do not click on any suspicious links or provide any personal information on any suspicious websites, emails or messages.

All rights of our firm and Ms. Heidi Chui are hereby expressly reserved.

Should you have any question, please contact us at info@sw-hk.com.

Thank you for your attention.

Stevenson, Wong & Co.

23 November 2023