Introduction

On 21 July 2023, The Stock Exchange of Hong Kong Limited (the “Exchange”) published the consultation conclusions (the “Conclusions”) on rule amendments following Mainland China regulation updates and other proposed rule amendments relating to the People’s Republic of China (the “PRC”) issuers. The Conclusions were issued in response to the consultation paper published by the Exchange on 24 February 2023 (see our news update on the consultation paper).

Background

On 17 February 2023, the State Council of the PRC issued the “Decision of the State Council to Repeal Certain Administrative Regulations and Documents”, and the China Securities Regulatory Commission (“CSRC”) issued the “Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies” and related guidelines (“New Regulations on Overseas Listing”). The New Regulations on Overseas Listing came into effect on 31 March 2023, followed by the repeal of the Special Regulations1 and the Mandatory Provisions2 .

Under the New Regulations on Overseas Listing, PRC issuers shall formulate their articles of association with reference to the Guidelines for the Articles of Association of Listed Companies issued by the CSRC. The New Regulations on Overseas Listing no longer require PRC issuers to follow the previously implemented Mandatory Provisions to (i) deem holders of domestic shares and H shares (which are both ordinary shares) as different classes of shareholders, thereby removing the class meeting requirements applied to holders of domestic shares and H shares in certain circumstances; and (ii) use arbitration to resolve disputes involving H shareholders, thereby removing the arbitration requirements.

The New Regulations on Overseas Listing also introduced a new filing regime for all direct and indirect overseas listings and securities offerings by Mainland based companies.

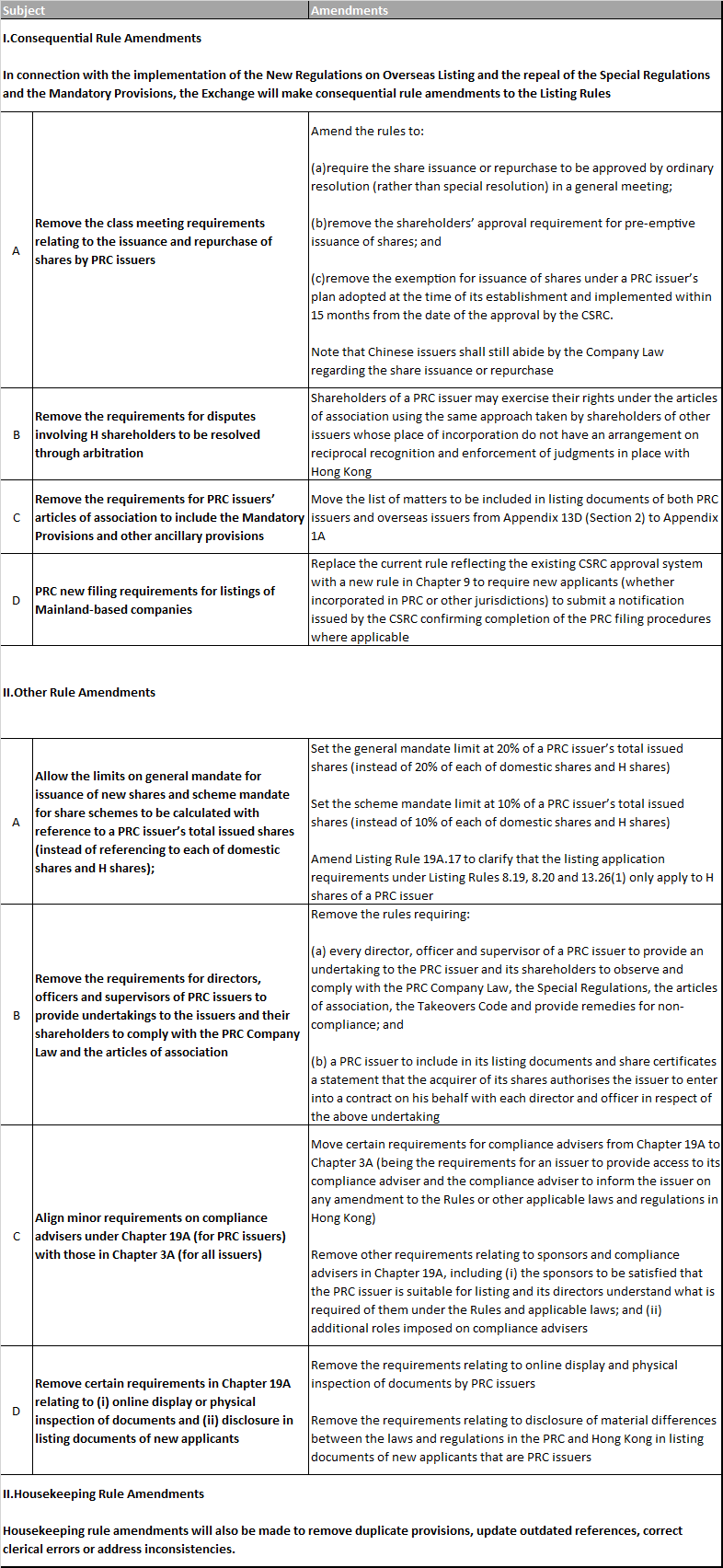

The amendments to the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (“Listing Rules“) will come into effect on 1 August 2023, and are summarised in the table below:

Analysis and takeaways

The Exchange has made corresponding amendments to the Listing Rules to align with the regulatory rules in Mainland China, and ensure that the rules applicable to Chinese issuers are more consistent with other overseas companies.

PRC issuers must still adhere to their existing articles of association concerning class meetings and other provisions that were originally formulated based on the Mandatory Provisions until and unless they amend their articles of association to remove such provisions. In general, where PRC issuers voluntarily propose to amend their articles of association to remove the class meeting requirements, they should obtain approvals of domestic shareholders and H shareholders at separate class meetings based on their existing articles of association.

Please contact our Partner Mr. Rodney Teoh for any enquiries or further information.

This news update is for information purposes only. Its content does not constitute legal advice and should not be treated as such. Stevenson, Wong & Co. will not be liable to you in respect of any special, indirect or consequential loss or damage arising from or in connection with any decision made, action or inaction taken in reliance on the information set out herein.

1The Special Regulations on the Overseas Offering and Listing of Shares by Joint Stock Limited Companies (國務院關於股份有限公司境外募集股份及上市的特別規定) issued by the State Council of the PRC on 4 August 1994, as amended, supplemented or otherwise modified from time to time.

2The Mandatory Provisions for Companies Listing Overseas set forth in Zheng Wei Fa (1994) No. 21 issued on 27 August 1994 by the State Council Securities Policy Committee and the State Commission for Restructuring the Economic System.