On 24 March 2023, The Stock Exchange of Hong Kong Limited (the “Exchange”) published the consultation conclusions (the “Conclusions”) on the new listing framework for Specialist Technology Companies (“STCs”). The Conclusions were issued in response to the two-month consultation (the “Consultation”) in respect of the consultation paper (the “Consultation Paper”) published by the Exchange on 19 October 2022 (see our news update on the Consultation).

The new listing regime will be added as Chapter 18C of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Listing Rules”), and the corresponding amendments, together with the Guidance Letter on Specialist Technology Companies (the “Guidance Letter”) will come into effect on 31 March 2023. Commencing on the same day, companies may submit a formal application for listing under the new regime.

The Exchange will implement the proposals as set out in the Consultation Paper, subject to certain amendments. Set out below are the key features of the new listing regime.

Definition of “Specialist Technology Companies”

The Exchange will adopt the proposed definitions of STCs without amendment,1 which is defined as “a company primarily engaged (whether directly or through its subsidiaries) in the research and development of, and the commercialisation and/or sales of, Specialist Technology Products (“STPs”) within an acceptable sector of a Specialist Technology Industry”.

STP is defined as “a product and/or service (alone or together with other products or services) that applies Specialist Technology”, and “Specialist Technology” is defined as “science and/or technology applied to products and/or services within an acceptable sector of a Specialist Technology Industry”.2

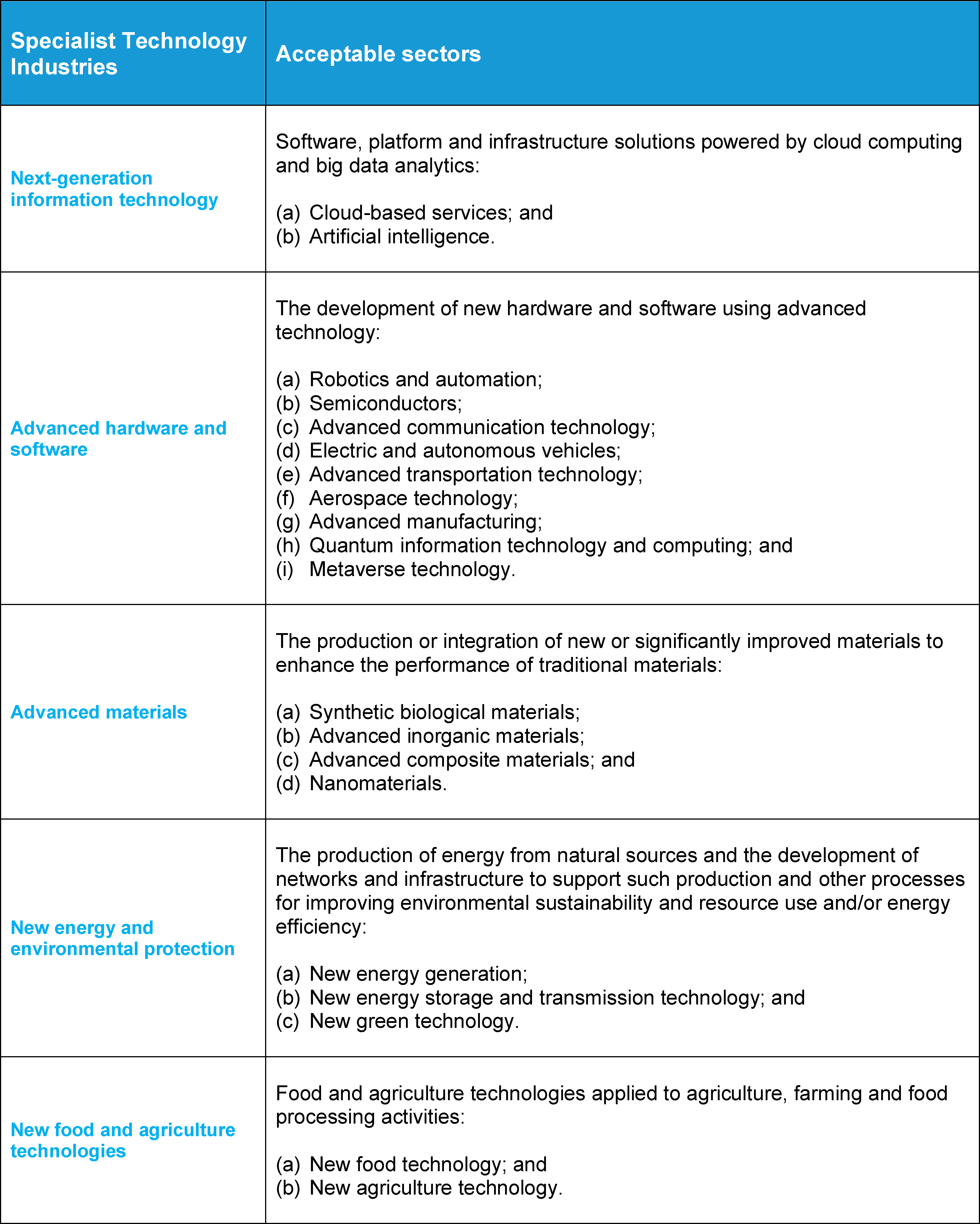

List of Specialist Technology Industries and acceptable sectors

In respect of the Specialist Technology Industries and acceptable sectors, the Exchange will adopt the proposed list set out in the Consultation Paper with amendments, and the list will be published in the Guidance Letter to be updated from time to time by the Exchange after consultation with the Securities and Futures Commission and with its approval.3 Summary of the list of Specialist Technology Industries and the non-exhaustive acceptable sectors are as follows:4

The Exchange has specifically excluded blockchain and digital asset related business in the list as such companies’ success is considered generally attributable to the expansion of mining capacity, rather than the application of new technology, with minimal contribution of research and development (R&D) to the companies’ expected value5 .

Applicants falling outside the existing list of Specialist Technology Industries and acceptable sectors

An applicant falling outside the list of Specialist Technology Industries or acceptable sectors above may still be considered as “within an acceptable sector of a Specialist Technology Industry” for the purpose of the definitions of STC and “Specialist Technology” if it can demonstrate that:6

(a) it has high growth potential;

(b) its success can be demonstrated to be attributable to the application, to its core business, of new technologies and/or the application of the relevant science and/or technology within that sector to a new business model, which differentiates it from traditional market participants serving similar consumers or end users; and

(c) research and development significantly contributes to its expected value and constitutes a major activity and expense.

Such applicant must submit a pre-IPO enquiry to the Exchange before submitting a listing application under Chapter 18C of the Listing Rules7 , and the Exchange will assess by taking into account all relevant facts and circumstances and consult with the SFC and seek its approval.8

Companies with multiple business segments

In respect of applicants with multiple business segments, the Exchange will adopt a holistic assessment of the non-exhaustive factors set out in the Guidance Letter and take into account the following additional factors when assessing whether an applicant is eligible for listing under Chapter 18C:9

(a) the proportion of the revenue (if any) generated by the Specialist Technology business segment(s) relative to the total revenue of the company (instead of prescribing a “bright line” percentage threshold); and

(b) the reason for retaining the non-Specialist Technology business segment(s) and the history of the company’s operations.

Categorisation of Commercial / Pre-Commercial Companies

The Exchange has adopted its proposal to accommodate the listings of Commercial Companies and Pre-Commercial Companies, with more stringent requirements imposed on Pre-Commercial Companies than Commercial Companies11 , and that all investors (including retail investors) be allowed to subscribe for, and trade in, the securities of Pre-Commercial Companies.12

Requirements

The below table sets out a comparison of the key requirements for Commercial Companies and Pre-Commercial Companies to be eligible for listing as set out in the Conclusions:

Additional qualification requirements for Pre-Commercial Companies24

- Primary reason for listing must be for raising funds for the R&D of, and the manufacturing and/or sales and marketing of, its STPs to bring them to commercialisation and achieving the Commercialisation Revenue Threshold (i.e. HK$250 million for an audited financial year);

- Demonstrate, and disclose in its Listing Document, a credible path to achieving the Commercialisation Revenue Threshold; and

- Have available working capital (after taking into account the IPO proceeds of the applicant) to cover at least 125% of its group’s costs (which must substantially consist of general, administrative and operating costs and R&D costs) for at least the next 12 months

Post-IPO lock-up25

Scope of the target persons subject to post-IPO lock-up of STCs is wider than the main board issuers with a longer lock-up period. In particular, the applicable post-IPO lock-up for STCs is as follows:

Analysis and Takeaways

While the value of STCs may be difficult to estimate, due diligence and in-depth research on the capabilities of performance of STCs, as well as the participation of investors with professional experience and industry expertise are crucial to the price setting of shares of STCs. The IPSI mechanism, with a 50% share allocation percentage requirement, introduced by the Exchange in view of overcoming the difficulty in price-setting, has in fact created certain challenges for STC listing applicants as they lose some flexibilities in seeking general investors’ support.

Nevertheless, the introduction of the IPSI mechanism, together with other adjustments made after considering the market feedback, such as lowering the market capitalisation requirement for listing and modifying the requirements for the minimum R&D expenditure ratio, demonstrated the Exchange’s efforts in promoting the feasibility of the new listing regime without compromising the protection offered to investors.

This new route to the market is expected to support some of the most innovative and progressive companies of the future. Since the listing reforms implemented by the Exchange in 2018, Hong Kong has made a great leap forward in catching up with the international capital market’s development progress of regulatory framework to accommodate the ever-changing market needs. The introduction of such series of rules and regulatory frameworks, including this new Specialist Technology chapter, will greatly enhance Hong Kong’s competitiveness as a fundraising market in Asia, and Hong Kong would be able to make an even greater use of its connectivity with Mainland China.

Please contact our Partner Mr. Rodney Teoh for any enquiries or further information.

This news update is for information purposes only. Its content does not constitute legal advice and should not be treated as such. Stevenson, Wong & Co. will not be liable to you in respect of any special, indirect or consequential loss or damage arising from or in connection with any decision made, action or inaction taken in reliance on the information set out herein.

1 Conclusions, p. 6

2 Conclusions, pp. 6 and 7

3 Conclusions, p. 12

4 Conclusions, pp. V-2 to V-6, paragraph 7 of the Guidance Letter

5 Conclusions, pp. 10 to 11

6 Conclusions, pp. 11 and V-7, paragraph 10 of the Guidance Letter

7 Conclusions, p. V-7, paragraph 11 of the Guidance Letter

8 Conclusions, p. V-7, paragraphs 12 and 13 of the Guidance Letter

9 Conclusions, pp. 14 and V-8, paragraphs 16 and 17 of the Guidance Letter

10 Companies that have achieved meaningful commercialisation of their Specialist Technology Products and achieved a minimum revenue of HK$250 million in the most recent audited financial year, and are also expected to demonstrate year-on-year growth of revenue from the Specialist Technology business.

11 Conclusions, pp. 17-18

12 Conclusions, pp. 18-19

13 Conclusions, pp. 1, 22 to 29

14 Conclusions, pp. 29 to 31

15 Conclusions, pp. 2 and 39 to 42

16 Conclusions, pp. 42 to 43

17 Conclusions, pp. 45 to 62

18 Conclusions, pp. 58-59

19 Conclusions, p. 60

20 Conclusions, pp. 75-84

21 Conclusions, pp. 82 to 84

22 Conclusions, pp. 84 to 88

23 Conclusions, p. 90

24 Conclusions, pp. 63 to 70

25 Conclusions, pp. 93 to 100

26 Key personnel responsible for the STC’s technical operations and/or the R&D of its STP(s) (including the head and the key personnel of its R&D department) whose expertise is primarily relied upon by the company for the development of its STP(s), and the lead developer(s) of the core technologies in relation to the STP(s). In determining whether a person should be designated as a Key Technical and R&D Personnel, an applicant should consider factors including the shareholding of such personnel, his/her remuneration relative to other R&D staff, and his/her seniority.