史蒂文生黃律師事務所(簡稱「史蒂文生黃」)作為君百延集團控股有限公司(簡稱「君百延」,股票編號:8372.hk)的香港法律顧問,就其在香港聯合交易所GEM的首次公開發行提供諮詢。

是次首次公開發行共發行1.68億股,每股售價定為港幣0.335元,是次發行共集資約港幣5,630萬元。

君百延為一家成熟的醫療儀器分銷商,於香港醫療儀器市場擁有逾19年經驗。

君百延的客戶包括香港的私立和公立醫院、私家診所、非牟利組織及大學。

史蒂文生黃團隊由企業部合夥人勞恒晃律師和朱㥣潛律師、以及劉硯楓高級律師領導,團隊成員包括陳元龍註冊外地律師、以及梁偉杰法律助理,為是次首次公開發行提供了全程專業法律服務。

是次首次公開發行的獨家保薦人為國泰君安融資有限公司。獨家全球協調人為國泰君安證券(香港)有限公司。

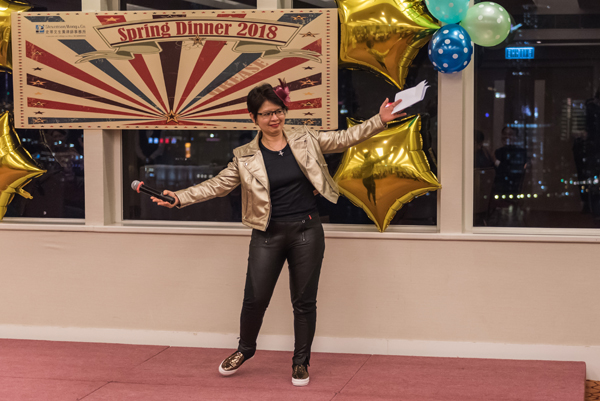

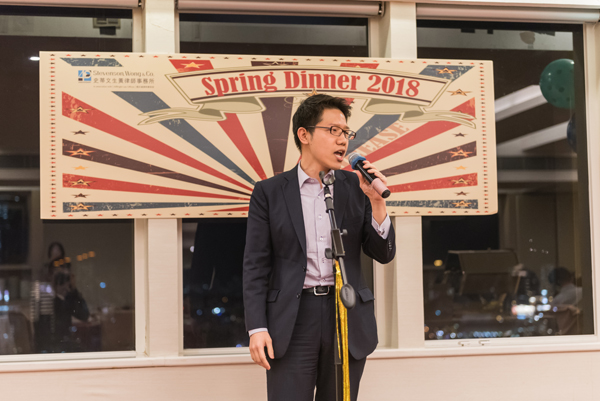

由左至右: 陈元龙律师、刘砚枫高級律师、君百延集團控股有限公司主席兼行政總裁黃碧君女士、合伙人劳恒晃律师